The impressive element of the case, and the reason it is noteworthy, is the synergy that the Schmidts' lawyers achieved between two experts - one mining expert, Mr. Warren Coalson (his actual name), and Mr. Orell Anderson, an experienced mining appraiser. It takes some doing to convince a jury that the value of vacant property should reflect its highest-and-best-hypothetical use as a mining operation, but that is exactly what Coalson, Anderson, and the Schmidts' lawyers did.

How did they do it?

The first and most obvious hurdle Schmidt had to clear is one of the oldest tricks in the condemnor's playbook, the "You Could Never Use That Property For Anything" defense: SDG&E claimed county authorities would never permit a mining operation on the Schmidt property, thus the mining value of the property had already been lost long ago when the county instituted mining permit regulations in the 1980s. See? Your property has no value. The government took it away long ago when it decided you could never use your property for anything.

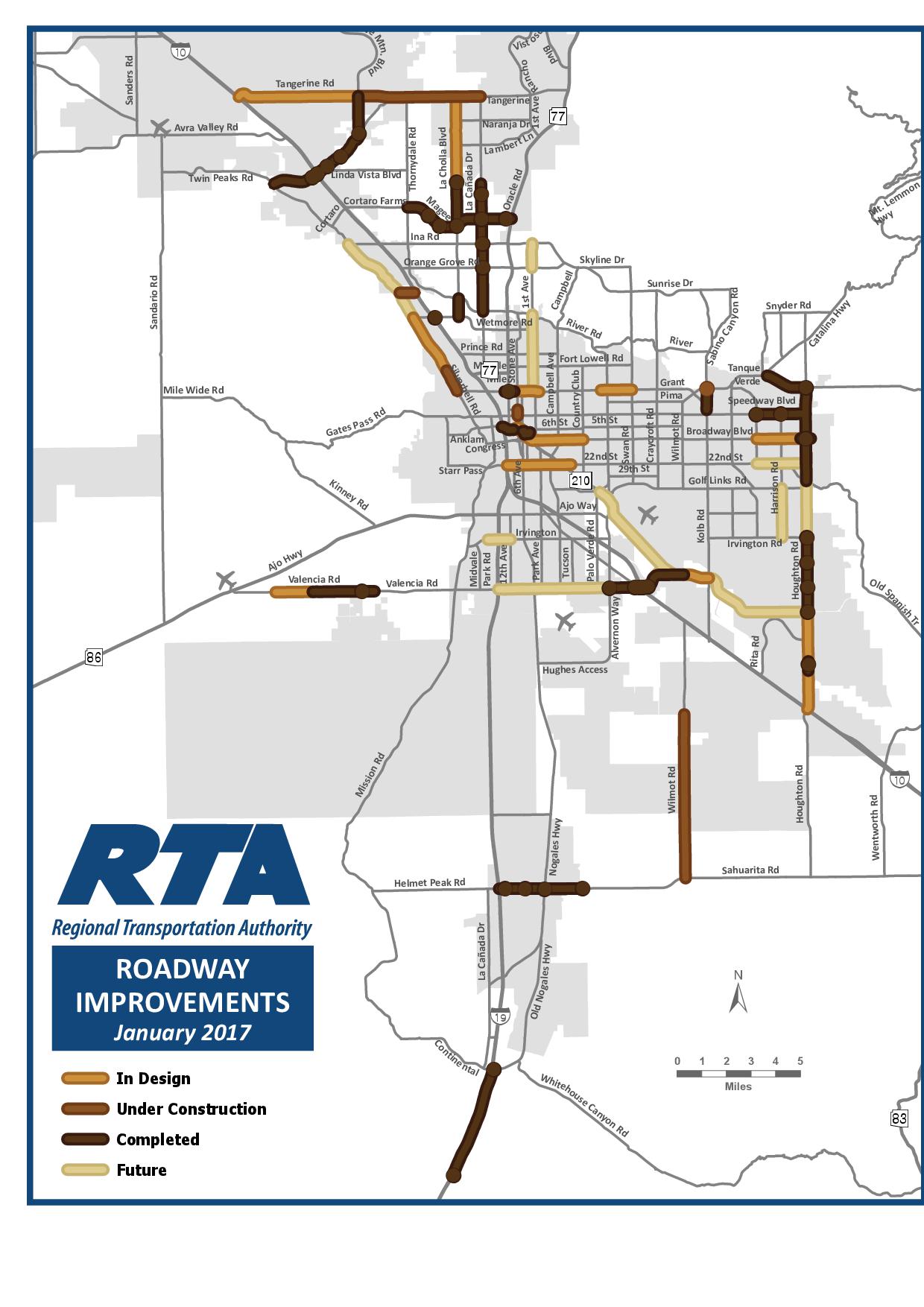

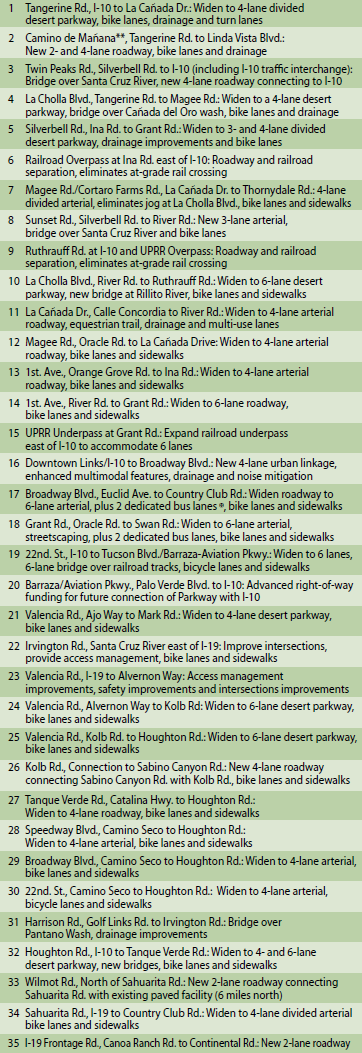

Pima County is notorious for using this tactic - particularly when it comes to the numerous floodplain regulations and prohibitions on construction within watercourses. The City of Tucson likes to use their Major Streets and Routes Plan (which sometimes places desired-future-roadway widths deep into private property) to contend the City already owns most of the frontage around town anyway, so why should the City have to pay for the mere formality of transferring title to itself?

Fortunately, the Schmidts' lawyers were prepared. Coalson had completed a market study of construction aggregates and concluded supply did not match anticipated future demand, making the county likely to permit more mining operations in the near future. Anderson conducted an empirical study of mining permitting in the county and found mining operations had been permitted at a rate of 71.4%, and therefore concluded the likelihood of the Schmidt property being permitted for mining was reasonably probable. First hurdle: cleared.

The second hurdle Schmidt had to clear was properly valuing a vacant piece of property at its highest-and-best use as a mining operation when few comparable sales of such property existed. Appraisers use three approaches to valuation: the comparable sales approach (find other properties sold recently similar to the subject property and use those sales prices to extrapolate the subject property's value), the cost approach (vacant land value + depreciated cost to reconstruct improvements = subject property's value), and the income approach (present value of income stream realizable from subject property = subject property's value). Since the comparable sales and cost approaches were not feasible, Anderson conducted an income approach.

Using the income approach in eminent domain cases is tricky. First, in California and Arizona, the appraiser should show that the comparable sales approach is not viable for the subject property. Anderson did this. Then the appraiser must avoid two traps the courts prohibit: using estimated business profits as a proxy for income and extracting the value of the land from the profits from a hypothetical sale of the hypothetically developed property. The income approach must reflect value as extrapolated from the income derived from the real estate, not the income derived from the business on the real estate.

Presenting a quality opinion of value using the income approach is where the synergy between Coalson and Anderson shone through. First, Coalson testified that mining companies pay landowners a royalty rate on the materials the mining company extracts, which Coalson stated would be 15 percent for the Schmidt property. This was based on Coalson's supply/demand analysis. Coalson also provided a CALTRANS-sponsored study for which Coalson was on the technical review panel that stated the future price for the mined materials would be $15 per ton.